HSA QUALIFIED EXPENSES PLUS

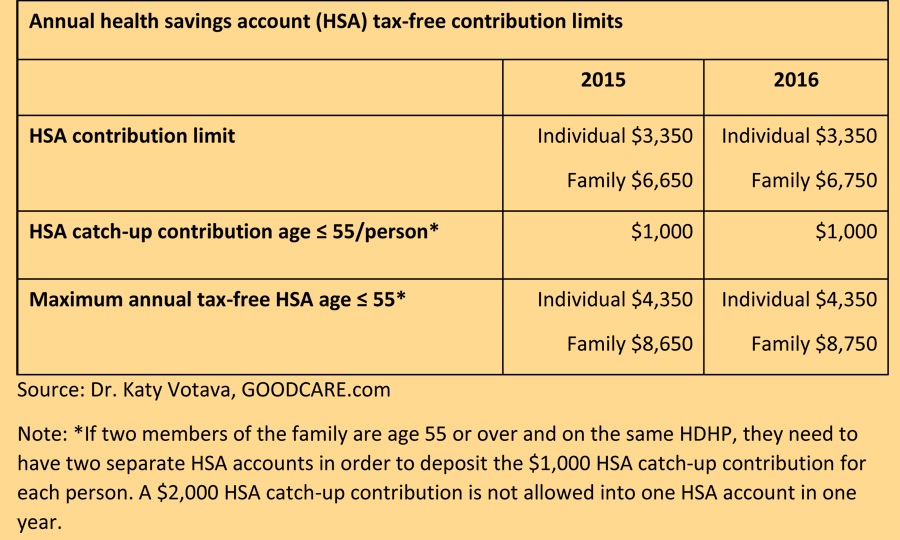

You’ll pay ordinary income tax on the money, plus a 20% withdrawal penalty. Should you withdraw money from an HSA for anything other than eligible medical expenses, it’s treated as a taxable distribution. That’s a very short list of what’s covered, but it underscores what an HSA is meant to be used for. The IRS publishes a list of HSA-eligible expenses, which includes: Money in your HSA grows tax-deferred and you can withdraw it tax-free for qualified medical expenses. Your employer can also contribute to your HSA on your behalf, though total employer-employee contributions cannot exceed the allowed annual limit. The limit is based on whether you have individual or family coverage and are adjusted annually for inflation. HSAs allow you to make contributions each year, up to a specified limit. These accounts are associated with high deductible health plans, which you might be enrolled in through your employer or through the federal health insurance marketplace. Questions regarding reimbursable health care expenses should be referred to a tax consultant.Health Savings Accounts are special savings accounts that allow you to set aside money for medical care. The following guidelines relate to expenses currently allowed and not allowed by the Internal Revenue Service as deductible medical expenses. Also, expenses that are merely beneficial to one's general health (for example, vacations) are not expenses for medical care. Examples include face lifts, hair transplants, and hair removal (electrolysis). Expenses for solely cosmetic reasons generally are not expenses for medical care. The expenses must be to alleviate or prevent a physical defect or illness.

"Medical care" expenses as defined by IRS Code, Section 213(d) include amounts paid for the diagnosis, treatment, or prevention of disease, and for treatments affecting any part or function of the body. Health FSA - Money in the FSA can be used to reimburse yourself for medical and dental expenses incurred by you, your spouse or eligible dependents (children, siblings, parents and other dependents as defined in your plan documents).

An employer may limit what expenses are eligible under an HRA plan. HRA - Money in the HRA can only be used to pay for eligible medical expenses incurred by employees and their dependents enrolled in the HRA. HSA - Money in your HSA can be used to reimburse yourself for medical and dental expenses incurred by you, your spouse or eligible dependents (children, siblings, parents and others who are considered an exemption under Section 152 of the tax code). You can use your Health FSA, HRA, or HSA to reimburse yourself for medical and dental expenses that qualify as federal income tax deductions (whether or not they exceed the IRS minimum applied to these deductions) under Section 213(d) of the tax code. What FSA expenses, HRA expenses and HSA expenses can be reimbursed? Health Reimbursement Arrangements Answers.Caution: Fradulent Calls Impersonating American Benefits Group.Education Campaigns for HSA and Health FSA.Video - How Do I Use This Investment Tool.

0 kommentar(er)

0 kommentar(er)